What happens when the world’s #2 economy collapses? It’s been like a slow-motion train wreck. So, let’s look at it now.

As mentioned in last year’s blog, the collapse of the Chinese housing development market is colossal. Last year on Feb 4, 2024, I posted that creditors were given the green light to start selling assets of Evergrande, the once-largest developer in China.

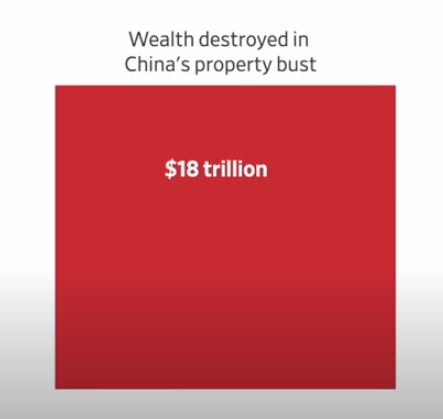

To grasp the magnitude of the collapse of the Chinese housing development market. Start with the Evergrande fiasco. They were more than $300 billion in debt in December 2023 at the time of Evergrande’s collapse and sell-off. Country Garden then became the largest property development company in China. But what’s the total impact on China’s housing market? Figure 1 shows the size in US $ of China’s property bust. Roughly equivalent to about $60K US per Chinese household. This amount represents the total GDP for China in one year.

This is an amazing amount of money. For comparison, the 2008-2009 Financial meltdown in the U.S. was “only” $6.5 trillion. So, the Chinese housing market meltdown is 3x the size. See Figure 2 for comparison.

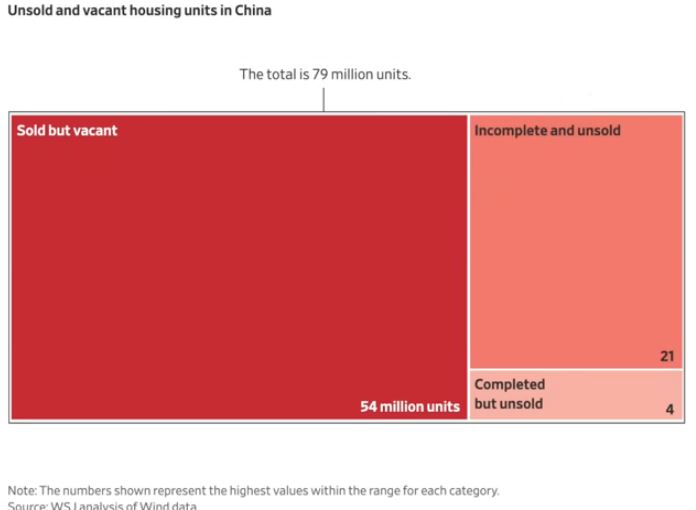

Currently, China has a huge oversupply of unsold housing totaling 79 million units (Figure 3.) This is more than the entire number of U.S. Housing market units. It has been estimated that this is enough to house the entire population of France.

The demand for the remaing housing units has dropped off preciptously (Figure 4). Everybody lost their money already.

What’s next for China?

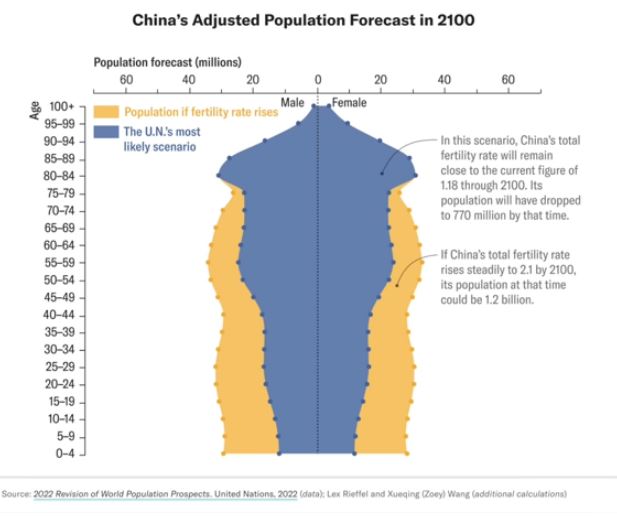

So, what does the future hold for China? It’s all based on Demographics. China’s one-child policy has doomed the country. The CCP has a habit of thinking linearly. Linear thinking is stupid thinking. As with other Chinese mistakes these events things don’t go wrong on a small scale. Do you remember Mao’s Great Leap Forward fight against sparrows as part of the Four Evils Campaign? This resulted in the Great Chinese Famine from 1959-1961 resulting in 45 million deaths. Figure 5 shows the current and projected future demographics of China. Demographics means the number and age of China’s population. Currently, there are barely enough people to support the population of China. In the future, things look even worse. Treat Figure 6 as a key to the plots in Figure 5. And, no, this isn’t a Rorschach test.

Figure 5 – Demographics of China through the 22nd century. See Figure 6 for a key to these plots.

Figure 5 shows the balance between number of males and females in the population from 2024 to 2100. The vertical axis (Y – axis) is increasing age while the horizontal axis ( X – axis) shows the number of people with respect to each sex. A surviving population has a broad base like a pyramid. Unfortunately, these data show that China is doomed demographically. Use Figure 6 as a key to understanding the graphs in Figure 5.

Figure 5 is just a projection, but it gives you an idea of what is possible with a significant change on the part of the CCP. Actually, they’d need to start having babies at an alarming rate. With most of their population (women) post-menopausal, this is very unlikely. Then again, there’s always cloning. I probably shouldn’t give them any ideas. It will probably go wrong, too.

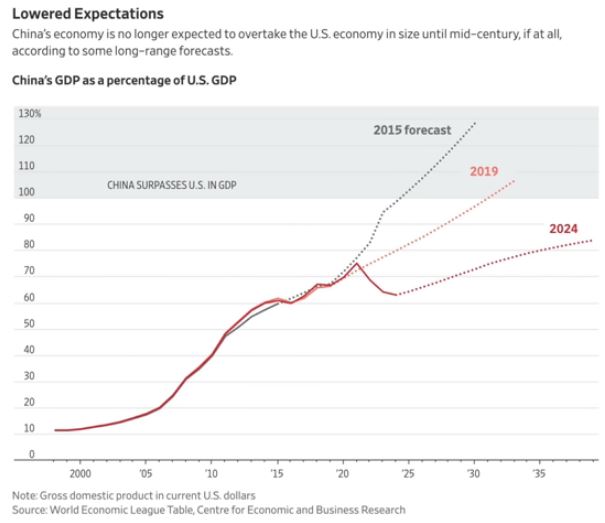

This housing crisis basically killed China’s economy. Any hope to have its economy overtake the U.S. before 2050 is no longer possible, if at all. Likely, China will no longer exist by 2100. Figure 7 shows previous predictions of China’s GDP Growth curve through 2024. It is likely much flatter to negative now.

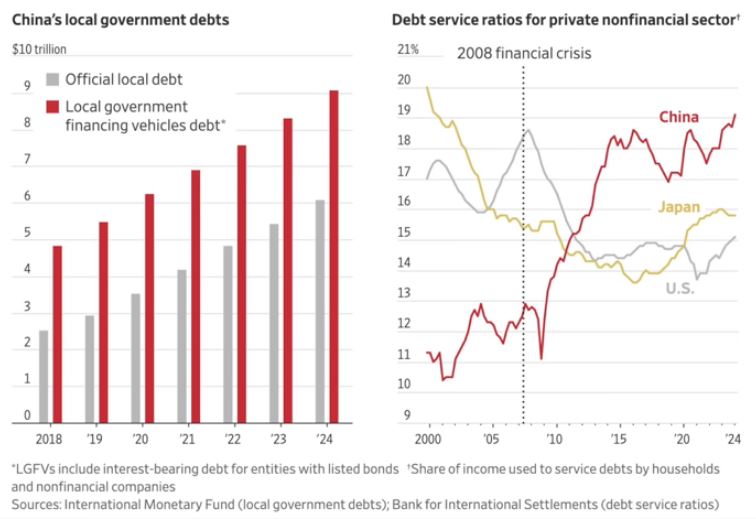

And, if that weren’t enough (and don’t you think it ought to be?), China’s debts are far out scaling their income. Previously, the CCP let local governments fund themselves by selling land to development companies. The local governments are now actually trying to pay debts using unfinished housing units.

China has no plan to fix this except by possibly manipulating its currency. This all but puts a nail in the coffin for China’s desire for world dominance. And, according to Peter Zeihan, in his Youtube blog, China Has No Chance (https://www.youtube.com/watch?v=6e_axmH0UHk) China can’t go to war with the U.S. because it has no way to store anything for more than 90 days and its Navy can’t protect ships bringing supplies.

China will continue to be dependent on the U.S. economy to sell it’s products. Since China doesn’t have enough resources to support it’s population, i.e, they are a net importer of raw materials and don’t have a Navy to protect the shipment of those goods, China will continue to depend on the U.S. Navy to keep the world’s seaways open.

*NOTE much of this material was from “China’s Economy Is Burdened by Years of Excess. Here’s How Bad It Really Is.” by Jason Douglas and Ming Li of the Wall Street Journal. See: https://www.wsj.com/world/china/china-economy-excess-debt-gdp-46c69585 and a rehash by Tony on his Youtube Channel, China Update.